Science & Environment

Science & Environment

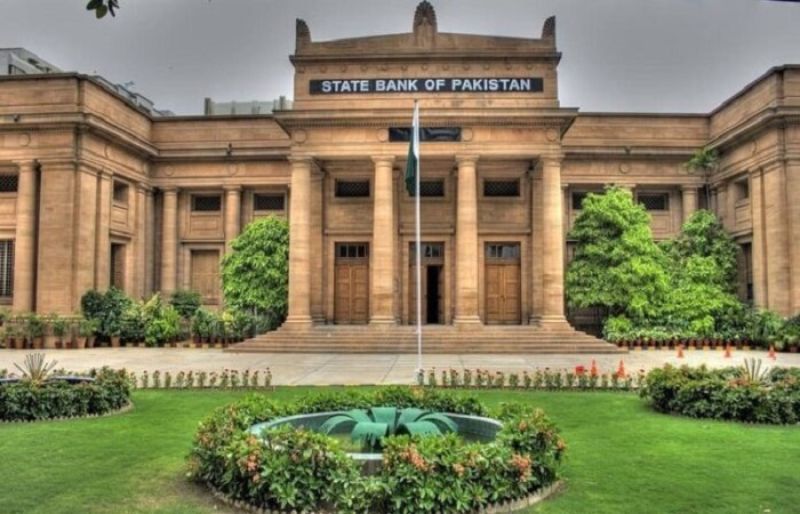

IMF says talks continuing virtually with Pakistan for fresh…

The International Monetary Fund (IMF) is considering a new bailout package for Pakistan under its Extended Fund Facility (EFF), according to Julie Kozak, the IMF’s director of communications.

In a press briefing held in Washington, Kozak highlighted the significant progress made during the recent IMF mission’s visit to Pakistan from May 13 to 23.

Kozak emphasized that the IMF mission’s visit resulted in substantial advancements towards reaching a staff-level agreement with Pakistan. “Pakistan can be supported under a new extended funding facility,” she stated, indicating the potential for continued financial assistance to bolster the country’s economy.

The discussions between the IMF and Pakistan are ongoing, with virtual dialogues playing a crucial role in the negotiations. Kozak assured that the IMF remains committed to supporting Pakistan through these challenging times, underscoring the importance of the EFF in providing necessary financial aid.

According to officials of the Ministry of Finance, Pakistan is expected to receive a new three-year loan program worth $6 to $8 billion from the IMF. Moreover, the budget for the new financial year is also being prepared as per the recommendations and conditions of the IMF.

On May 24, Pakistan and the IMF made notable progress in negotiations for a new loan program, despite concluding the recent round of talks without a staff-level agreement. The IMF’s 10-day visit to Pakistan, which began on May 13, laid a promising foundation for future discussions aimed at securing a comprehensive financial package, said a statement issued at the conclusion of the visit.

The IMF delegation’s visit emphasized critical areas such as human resource development, social security, and addressing the impacts of climate change. “Adequate progress has been made towards a staff-level agreement,” stated the IMF in their announcement. “Consultations will continue virtually to finalize the new program for Pakistan.”

It further said that the reforms aimed at achieving stable development in Pakistan. Islamabad is vigorously pursuing a new and larger loan program from the IMF, with officials from the Ministry of Finance aiming for a bailout package between $6 to $8 billion.

The 10-day negotiations reviewed Pakistan’s request and discussed comprehensive economic policies and reforms designed to achieve stable growth, the IMF statement said.