Science & Environment

Science & Environment

Unified Pension Scheme vs OPS vs NPS: How is…

Employees have the option to choose between UPS and NPS.So how does UPS compare to NPS? And how does it compare to the OPS? We take a look:

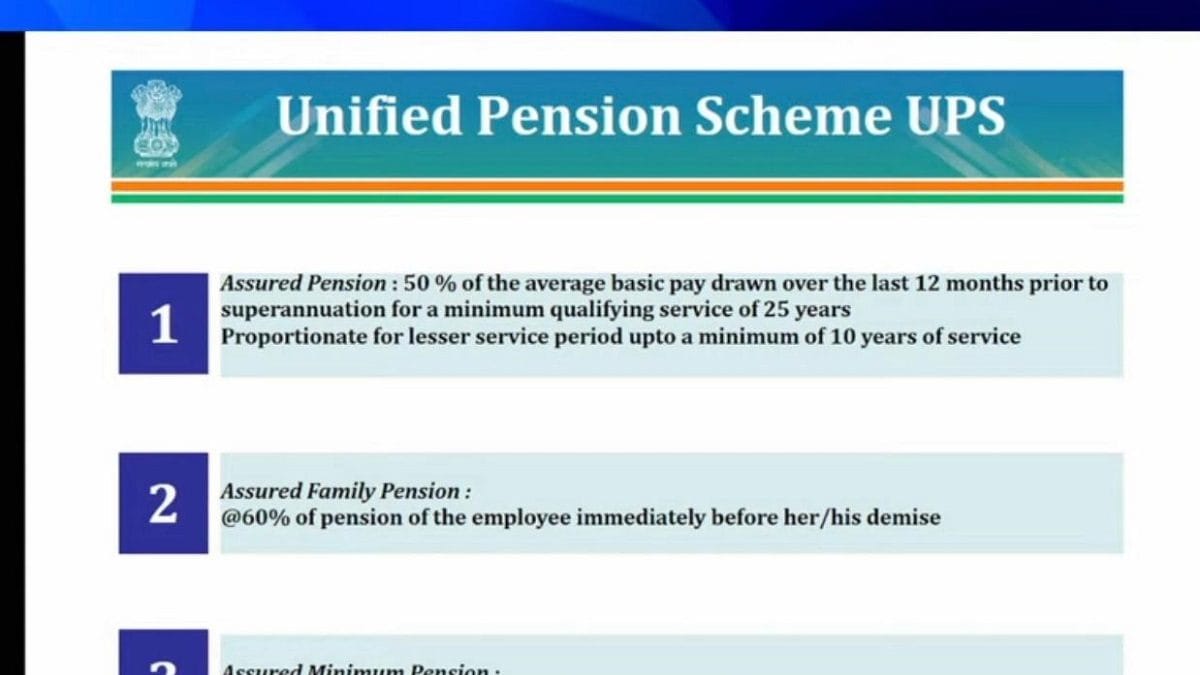

Unified Pension Scheme (UPS): Top Features

- Under the UPS, employees with a minimum qualifying service of 25 years will receive an assured pension of 50% of the average basic pay drawn over the last 12 months prior to superannuation.

- For service periods between 10 and 25 years, the pension will be proportional.

- In the event of an employee’s demise, their family will receive an assured pension of 60% of the employee’s pension immediately before their demise.

- The scheme also includes an assured minimum pension of Rs 10,000 per month upon superannuation after a minimum of 10 years of service.

- The UPS will apply inflation indexation to the assured pension, assured family pension, and assured minimum pension.

- Dearness Relief will be based on the All India Consumer Price Index for Industrial Workers (AICPI-IW), similar to service employees.

- Additionally, employees will receive a lump sum payment at superannuation, calculated as 1/10th of monthly emoluments (pay + DA) for every completed six months of service. This lump sum payment is separate from gratuity and does not impact the assured pension amount.

- Employees choosing the UPS will not incur any extra financial burden. Their contribution will stay at 10 percent, while the government’s contribution will rise from 14 percent to 18.5 percent.

National Pension Scheme (NPS): Top Features

NPS and the newly proposed UPS differ in terms of government contributions, pension amounts, and family pension provisions.

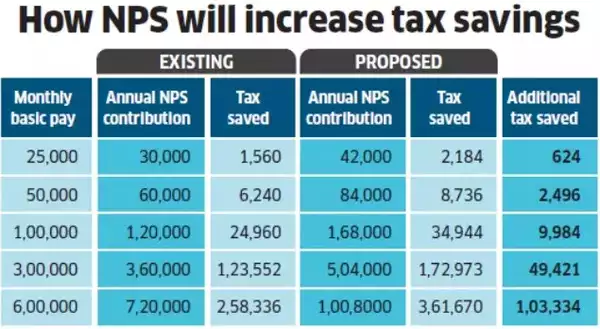

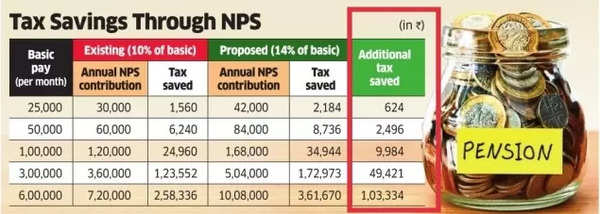

- Under NPS, central government employees contribute 10% of their basic salary, while the government contributes 14%, according to an ET report.

- The pension amount in NPS is not fixed as it is linked to market movements, whereas UPS provides an assured pension of 50% of the salary for those who joined the service after January 1, 2004.

- Family pension under NPS depends on the accumulated corpus in the pension fund and the chosen annuity plan at retirement.

- NPS has been implemented for all government employees, except those in the armed forces, who joined the central government on or after January 1, 2004. It is also available for private-sector employees. Most state/Union Territory governments have also notified NPS for their new employees.

Old Pension Scheme (OPS): Top Features

- The Old Pension Scheme (OPS) provided retired government employees with a monthly pension equal to 50 percent of their last drawn salary. This amount was subject to increase in line with the hike in the Dearness Allowance (DA) rates. Upon retirement, employees were also entitled to receive a gratuity payment, with a maximum limit of Rs 20 lakh.

- Under the OPS, if a retired employee passed away, their family would continue to receive pension benefits. Another notable aspect of the

OPS was that no deductions were made from an employee’s salary towards pension contributions, which is in contrast to the NPS.

Recently, several states in India, including Himachal Pradesh, Rajasthan, Chhattisgarh, and Punjab, have made the decision to revert to the Old Pension Scheme, moving away from the NPS.