Science & Environment

Science & Environment

Amit Shah Says Indian Stock Market Will Create Records…

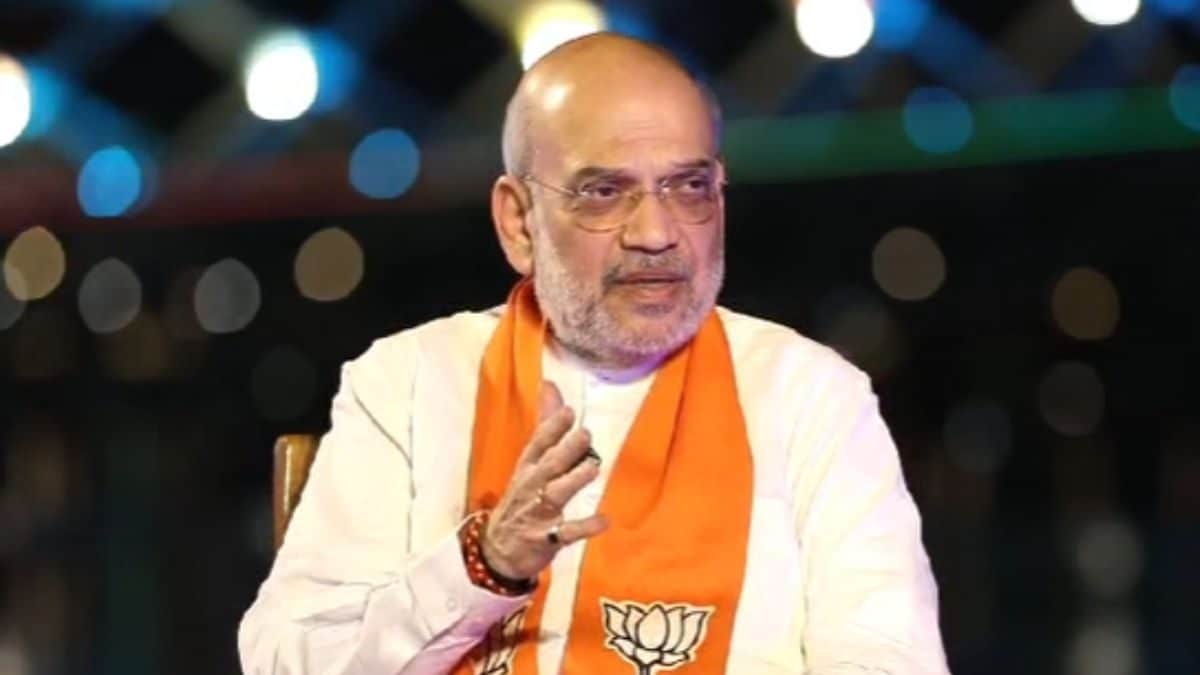

Union Home Minister Amit Shah. (Image: News18)

Amit Shah says the stock market has fallen more in the past as well. Thus, linking market movements directly to elections, is not wise. Maybe the fall was due to some rumours.

Indian Stock Market Amid Lok Sabha Elections: Home Minister and senior BJP leader Amit Shah on Monday showed confidence in his party returning to power for the third time in a row and said the Indian stock market will create new records on June 4. The results of the Lok Sabha elections, which are going on in seven phases, will be announced on June 4.

On this, Amit Shah in an interview with NDTV said, “The market has fallen more in the past as well. Thus, linking market movements directly to elections, is not wise. Maybe the fall was due to some rumours. In my opinion, buy before June 4. The market is going to shoot up.”

In the month of May so far, the Sensex has declined over 3,000 points or 4 per cent to 71,940 now, as compared with 74,981 on April 30. VIX has also surged to 52-week high of 21, which indicates volatility in the markets. Some analysts are linking it with the likely lower victory margin for NDA in the ongoing general elections.

Amit Shah said that due to different reasons, there are ups and downs in the stock market. “Please note my point, on June 4, this stock market will once again create new records.”

Shah explained why he was optimistic about where the Indian stocks markets were heading. “Whenever there is a steady government, markets do well. Modiji is coming back as the prime minister for the third time. Thus, my prediction.”

On the elections, Amit Shah said that in the three phases till now, I expect BJP to win over 190 seats. “Thus, we have built a good lead. I am also positive that the fourth phase is going to go very well for us. I expect to gain ground in eastern India—Bengal, Odisha. Even in North East, we should do better.”

On Monday, the BSE Sensex declined 656.52 points to 72,007, while the NSE Nifty also dropped 174.15 points to below 21,900. Tata Motors, JSW Steel, Tata Steel, SBI and NTPC were the biggest laggards dragging the domestic equities market.

The rupee also opened on a flat note at 83.51 against US dollar.